Do Contractors Charge Tax . The basic questions for tax on construction invoices always come down to this: Do contractors have to collect sales tax from the project owner? Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do contractors charge sales tax? In most states, construction contractors must pay sales tax when they purchase materials used in construction. Most states follow the general rule that contractors are consumers. Read to learn requirements related to. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Do you charge tax on materials, labor or both?. Do home improvement contractors charge sales tax? Most independent contractors also pay income tax in the state where.

from www.examples.com

The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do contractors have to collect sales tax from the project owner? Most independent contractors also pay income tax in the state where. The basic questions for tax on construction invoices always come down to this: Do contractors charge sales tax? Do home improvement contractors charge sales tax? Most states follow the general rule that contractors are consumers. Read to learn requirements related to. In most states, construction contractors must pay sales tax when they purchase materials used in construction.

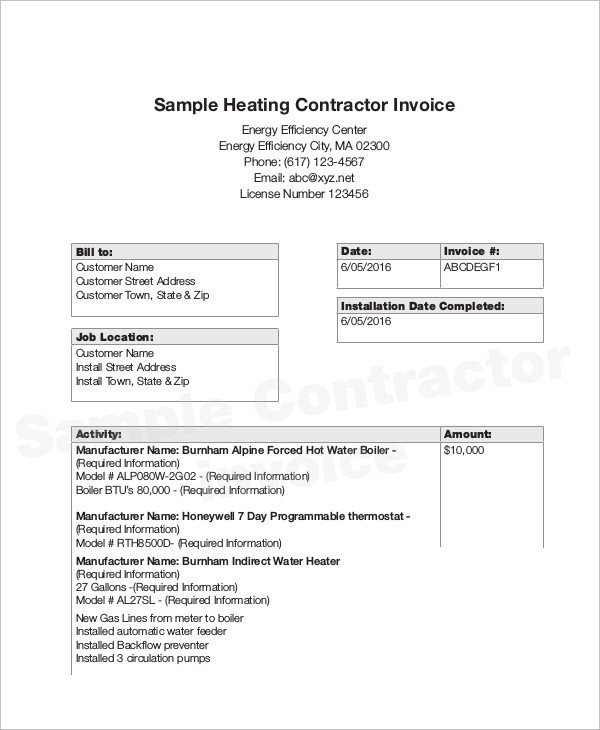

Contractor Invoice 13+ Examples, Google Docs, Google Sheets, Excel

Do Contractors Charge Tax The basic questions for tax on construction invoices always come down to this: Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Read to learn requirements related to. Most states follow the general rule that contractors are consumers. In most states, construction contractors must pay sales tax when they purchase materials used in construction. Do contractors have to collect sales tax from the project owner? Do contractors charge sales tax? Do you charge tax on materials, labor or both?. Do home improvement contractors charge sales tax? Most independent contractors also pay income tax in the state where. The basic questions for tax on construction invoices always come down to this:

From www.nutemplates.com

Contractor Invoice Template Contractor Invoices nuTemplates Do Contractors Charge Tax Do contractors have to collect sales tax from the project owner? Read to learn requirements related to. The basic questions for tax on construction invoices always come down to this: Most independent contractors also pay income tax in the state where. Do you charge tax on materials, labor or both?. The contractor charges the owner sales tax on 75% of. Do Contractors Charge Tax.

From www.paldrop.com

7 Tips for Filing Independent Contractor Taxes Do Contractors Charge Tax Do contractors charge sales tax? Most states follow the general rule that contractors are consumers. Do you charge tax on materials, labor or both?. Read to learn requirements related to. Do home improvement contractors charge sales tax? The basic questions for tax on construction invoices always come down to this: In most states, construction contractors must pay sales tax when. Do Contractors Charge Tax.

From www.pinterest.com

Do Contractors Charge to Estimate a Job? Estimate, Job, Contractors Do Contractors Charge Tax The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Read to learn requirements related to. Most states follow the general rule that contractors are consumers. Do you charge tax on materials, labor or both?. Do contractors have to collect sales tax from the project. Do Contractors Charge Tax.

From www.ferkeybuilders.com

How To Save Money On New Construction Cleaning Services In Alabama Do Contractors Charge Tax Do you charge tax on materials, labor or both?. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Do contractors charge sales tax? Most independent contractors also pay income tax in the state where. Most states follow the general rule that contractors are consumers.. Do Contractors Charge Tax.

From www.checkbca.org

How Much Does A General Contractor Charge BCA Do Contractors Charge Tax Do you charge tax on materials, labor or both?. Do home improvement contractors charge sales tax? In most states, construction contractors must pay sales tax when they purchase materials used in construction. Do contractors charge sales tax? Most independent contractors also pay income tax in the state where. Contractors are relatively unique in that they are both the consumer of. Do Contractors Charge Tax.

From fitsmallbusiness.com

Independent Contractor Taxes The Ultimate Guide Do Contractors Charge Tax In most states, construction contractors must pay sales tax when they purchase materials used in construction. Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do contractors have to collect sales tax from the project owner? Do home improvement contractors charge sales tax? Do contractors charge sales tax? Most independent contractors. Do Contractors Charge Tax.

From www.examples.com

Contractor Invoice 13+ Examples, Google Docs, Google Sheets, Excel Do Contractors Charge Tax Read to learn requirements related to. Most states follow the general rule that contractors are consumers. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Do home improvement contractors charge sales tax? Most independent contractors also pay income tax in the state where. The. Do Contractors Charge Tax.

From mavink.com

Contractor Cheat Sheet Do Contractors Charge Tax Do contractors have to collect sales tax from the project owner? In most states, construction contractors must pay sales tax when they purchase materials used in construction. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. The basic questions for tax on construction invoices. Do Contractors Charge Tax.

From www.pinterest.com

How Much Should a Contractor Charge? Contractors, Charging, Profit Do Contractors Charge Tax In most states, construction contractors must pay sales tax when they purchase materials used in construction. Do you charge tax on materials, labor or both?. Do home improvement contractors charge sales tax? Do contractors charge sales tax? The basic questions for tax on construction invoices always come down to this: Read to learn requirements related to. Most states follow the. Do Contractors Charge Tax.

From old.sermitsiaq.ag

Contractors Invoice Template Do Contractors Charge Tax The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Do you charge tax on materials, labor or both?. Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do contractors have to collect sales tax from. Do Contractors Charge Tax.

From getjobber.com

Indiana General Contractor License How to Apply Do Contractors Charge Tax Do contractors have to collect sales tax from the project owner? The basic questions for tax on construction invoices always come down to this: Do you charge tax on materials, labor or both?. Do home improvement contractors charge sales tax? The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as. Do Contractors Charge Tax.

From homeguide.com

2024 General Contractor Charges, Hourly Rates & Fee Percentage Do Contractors Charge Tax Most states follow the general rule that contractors are consumers. Do contractors have to collect sales tax from the project owner? In most states, construction contractors must pay sales tax when they purchase materials used in construction. The basic questions for tax on construction invoices always come down to this: The contractor charges the owner sales tax on 75% of. Do Contractors Charge Tax.

From renovationsatl.com

How Much Do General Contractors Charge Decoding Costs Do Contractors Charge Tax Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do contractors charge sales tax? In most states, construction contractors must pay sales tax when they purchase materials used in construction. The basic questions for tax on construction invoices always come down to this: Most states follow the general rule that contractors. Do Contractors Charge Tax.

From www.agriland.ie

Table Contractor association releases full 2020 ‘guide rates Do Contractors Charge Tax The basic questions for tax on construction invoices always come down to this: Most independent contractors also pay income tax in the state where. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Read to learn requirements related to. In most states, construction contractors. Do Contractors Charge Tax.

From www.reliabills.com

How Much Do Contractors Charge per Hour ReliaBills Do Contractors Charge Tax Do contractors have to collect sales tax from the project owner? Do home improvement contractors charge sales tax? Read to learn requirements related to. The contractor charges the owner sales tax on 75% of $4,000, or $3,000 (only the square footage used exclusively as a residence is exempt from. Most independent contractors also pay income tax in the state where.. Do Contractors Charge Tax.

From sprintlaw.com.au

Working As A Contractor Sprintlaw Do Contractors Charge Tax Do contractors charge sales tax? Do contractors have to collect sales tax from the project owner? Do home improvement contractors charge sales tax? The basic questions for tax on construction invoices always come down to this: In most states, construction contractors must pay sales tax when they purchase materials used in construction. Do you charge tax on materials, labor or. Do Contractors Charge Tax.

From invoicemaker.com

Independent Contractor (1099) Invoice Template Invoice Maker Do Contractors Charge Tax The basic questions for tax on construction invoices always come down to this: Do contractors have to collect sales tax from the project owner? Read to learn requirements related to. Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. The contractor charges the owner sales tax on 75% of $4,000, or. Do Contractors Charge Tax.

From www.taxconnex.com

Sales and Use Taxes for Contractors Do Contractors Charge Tax Contractors are relatively unique in that they are both the consumer of materials and retailers of their services. Do you charge tax on materials, labor or both?. Do contractors have to collect sales tax from the project owner? Do contractors charge sales tax? Most states follow the general rule that contractors are consumers. In most states, construction contractors must pay. Do Contractors Charge Tax.